Congress plans, students pay

Congress continues to deliberate about what needs to happen with the current deficit, which is increasing daily and, as of Saturday, stands at $14.4 trillion. According to the Fiscal Times, student loan rates are at a four-year high. In the meantime, students face the challenge of limited loan and scholarship availability and a future in which the American public could lose confidence in the government’s ability to control the deficit.

Lawmakers have recently been debating whether to raise the debt ceiling, a stated limit for government spending on credit, or to establish a plan that will cut spending. The American public and investors fear that without some form of action the government will default, according to the Huffington Post.

“It’s still extremely unlikely, but it is now something that can be talked about,” said Mark Vitner, a Wells Fargo senior economist, in a recent Huffington Post report.

Congress is expected to reach an agreement by mid-summer to reduce the debt ceiling by $1 trillion and enact $3 trillion in cuts over the next 10 years, according to the Fiscal Times. Many are skeptical that congress will solve the problem, but cuts across the board, scheduled debt reductions and action, rather than conjecture, are what will produce results.

“If you were in that room [the capitol], you’d see the seriousness of purpose and the degree to which people are going line by line,” said Gene Sperling, the president’s chief economic advisor, at the recent Peterson Foundation summit. “[Congress] is having serious discussions and serious proposals.”

On May 16, the government reached its debt ceiling mark of $14.294 trillion, but Congress and Treasury Secretary Timothy F. Geithner took what they called, “extraordinary measures,” by temporarily raising the debt limit ceiling and cutting investments for retirement and disability of federal civilian employees, according to the New York Times.

As bi-partisan deliberations continue, conservatives look to cut spending and liberals ponder the same, but through different means. Public investors have been buying as much insurance as possible. They’ve purchased twice the amount investors had at this point last year, according to the Huffington Post.

While American investors continue to express nervousness about the market, foreign investors have also lost confidence. On Thursday, the Federal Reserve watched as the foreign account investors dropped to a four-year low. Purchasers of the U.S’s debt are flocking to pull out of their investments.

What does this mean for students?

The current outstanding student loan debt is $875 billion dollars, and the average interest rate is close to 7 percent, according to the United States department of education. This debt is a threat to the U.S. economy, because based on the recent data, the debt could easily lead to default, which could temporarily foreclose the government, according to the International Business Times.

In 2010, the student default rate on federal loans was up by 0.2 percent at 8.9 percent. Out of 3.7 million borrowers, there will 327,669 students who will default on current loans this year, according to The Chronicle of Higher Education.

In Mary Pilon’s Wall Street Journal Blog, the Juggle, she says that students are facing an intense struggle as the economy recovers from a recession and big businesses are being bailed out. As the focus continues to be on the deficit, the belief is that ignoring student loans will lead to disaster in the future. The students that are taking out loans to pay for college will be paying off and suffering the government cuts in the future when the deficit could be prospectively worse, unless Congress takes action soon.

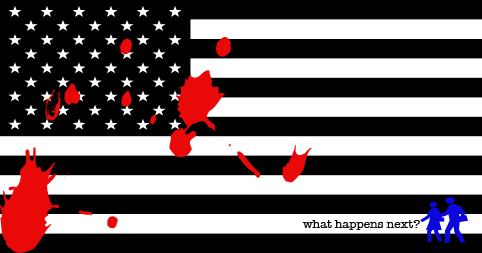

It’s likely that the best way to approach the situation is not as a problem with one answer. Only the future will tell what is going to happen next. Education, which prepares students for a life, is a heavy burden in this debt-laden economy. However, as the job market becomes fierce, it may also be the deciding factor in what kind of life one will have.