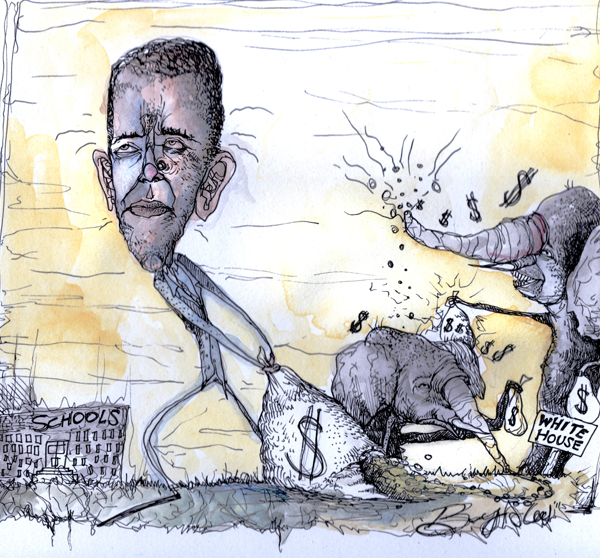

On Sept. 12, White House Press Secretary Jay Carney released President Barack Obama’s 2011 Jobs Act proposal. The proposition focuses on a payroll tax cut for 160 million workers next year, preventing teacher, police officer and firefighter layoffs; modernizing 35,000 public schools and extending nationwide wireless Internet services — without adding another cent to the rising deficit.

Obama spoke out to voters in his weekly public address on Saturday saying, “No more division or delay.” He traveled the country this week to rally support for the upcoming vote and advocate the importance of reviving the middle class.

“The number one issue for the people I meet is how we can get back to a place where we’re creating good, middle-class jobs that pay well and offer some security,” said Obama in his weekly address. “It’s time for the people you sent to Washington to put country before party — to stop worrying so much about their jobs and start worrying more about yours.”

One hundred thirty-nine House Democrats and 138 House Republicans as well as 43 Democratic senators and 37 Republican senators voted to reduce payroll taxes last year, according to Obama’s press release. Obama has faced a pragmatic and conflicted Congress concerning last year’s proposal, but the outlook for the new act seems likely to encourage bi-partisan votes.

At minimum, if the Jobs Act bill is approved by Congress, then it could stave off upcoming problems blowing over from the European debt crisis, reported Jackie Calmes for the New York Times. But the most significant attribute to the proposal is Obama’s plan to cut payroll taxes by nearly half and to avoid adding a monstrous sum to the deficit — even though the price tag for the stimulus hovers around $447 billion over the next ten years, according to the official proposal transcript.

The Congressional Budget Office supported employer payroll tax cuts as one of the most effective ways to reduce unemployment and in turn pump more money into the economy by supporting middle-class initiatives, according to the Jobs Act proposal. The most explosive incentive behind payroll tax cuts is that next year, instead of paying 6.2 percent on payroll expenses, firms with less than $5 million in payroll will see a reduction to 3.1 percent. For the average business’ payroll expense of $2.5 million, this will reduce its taxes by $80,000.

The Jobs Act proposal was released a week ago so its likelihood of becoming law is still in question. The effects that it may or may not have are purely speculative. However, this act could prove to stabilize a declining economy that many fear is headed for yet another recession. It could mean greater opportunities for college grads seeking employment in the small business industry, and it could also improve the education system’s ability to prepare students for the job market. But whether the act passes or not, some feel that the proposal isn’t necessarily about saving the American economy.

“I think it’s a way of immortalizing his presidency; it’s a last push of encouragement for a modern society that doubts whether it will be successful or not,” said third-year printmaking student Alexis Blaudeau. “It seems an appeasable option for both sides, but if [Obama] really wanted to do something that would ameliorate the future and time-stamp his presidency, then he would find a way to solve the student debt crisis.”